Section 179 Deductions are an amazing thing embedded in our tax code.

According to the IRS, Section 179 of the IRS code allows small businesses to deduct the cost of machinery, vehicles, equipment, furniture and other property. This was part of the American Recovery and Reinvestment Act of 2009. At that time, the maximum amount that a business could deduct was $250,000. In 2011, the maximum deduction that a small business could make was $500,000, but in 2012, the amount drops to $139,000.

According to Reuters, the #3 top tax tip:

3. Purchase Property Eligible for Section 179 Deduction. The maximum Section 179 deduction is $139,000 for eligible property placed in service in tax years beginning in 2012. This amount is reduced dollar for dollar by the excess of qualified property placed in service during the tax year over $560,000. Unless Congress takes further action, the maximum Section 179 deduction for tax years beginning in 2013 will be $25,000, and the phase-out threshold will be $200,000. However, watch out if the business is expected to have (or is close to) a tax loss for the tax year, advised Keller. There is an income limitation too, so Section 179 deductions that create or increase a business tax loss are disallowed, with the excess carried over to the following tax year.

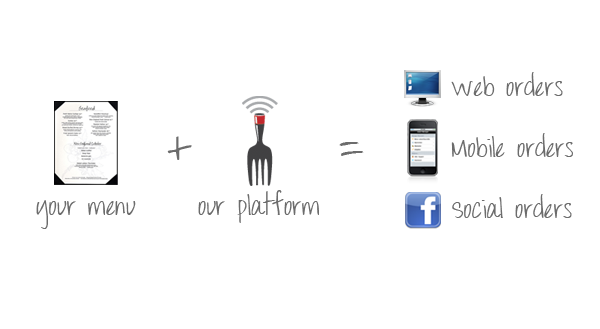

If you’ve been holding off ordering capital equipment (computers, iPads, telecom, etc) you have until December 31 to claim your purchases for 2012 tax purposes under Section 179 at current allowance. Oh, and have I mentioned our awesome Shopkeep offer? Yeah, that qualifies too!